Index Universal Life Insurance

Grow your money while protecting what matters most.

Index Universal Life (IUL) gives you market-linked growth potential, tax-advantaged cash value, and lifelong protection in one flexible policy—without putting your family’s future at risk.

- Tax-advantaged cash value growth linked to market indexes

- Downside protection with built-in minimum interest guarantees

- Flexible premiums and access to cash when you need it

Designed for steady, tax-smart growth.

See how a disciplined IUL strategy can help grow a supplemental tax-advantaged bucket for retirement, college, or future opportunities.

Why index universal life?

Four core benefits that set Index UL apart.

Market-linked upside

Your cash value is tied to index performance—giving you growth potential beyond traditional fixed accounts, without direct exposure to market losses.

Tax-advantaged growth

Cash value can grow tax-deferred, and with proper structuring, policy loans can provide tax-advantaged access to that value in the future.

Built-in protection

Your loved ones receive an income-tax-free death benefit, while you maintain access to your policy’s cash value during your lifetime.

Flexible access & control

Adjust premiums, update your death benefit, and access cash value for opportunities, emergencies, or supplemental retirement income.

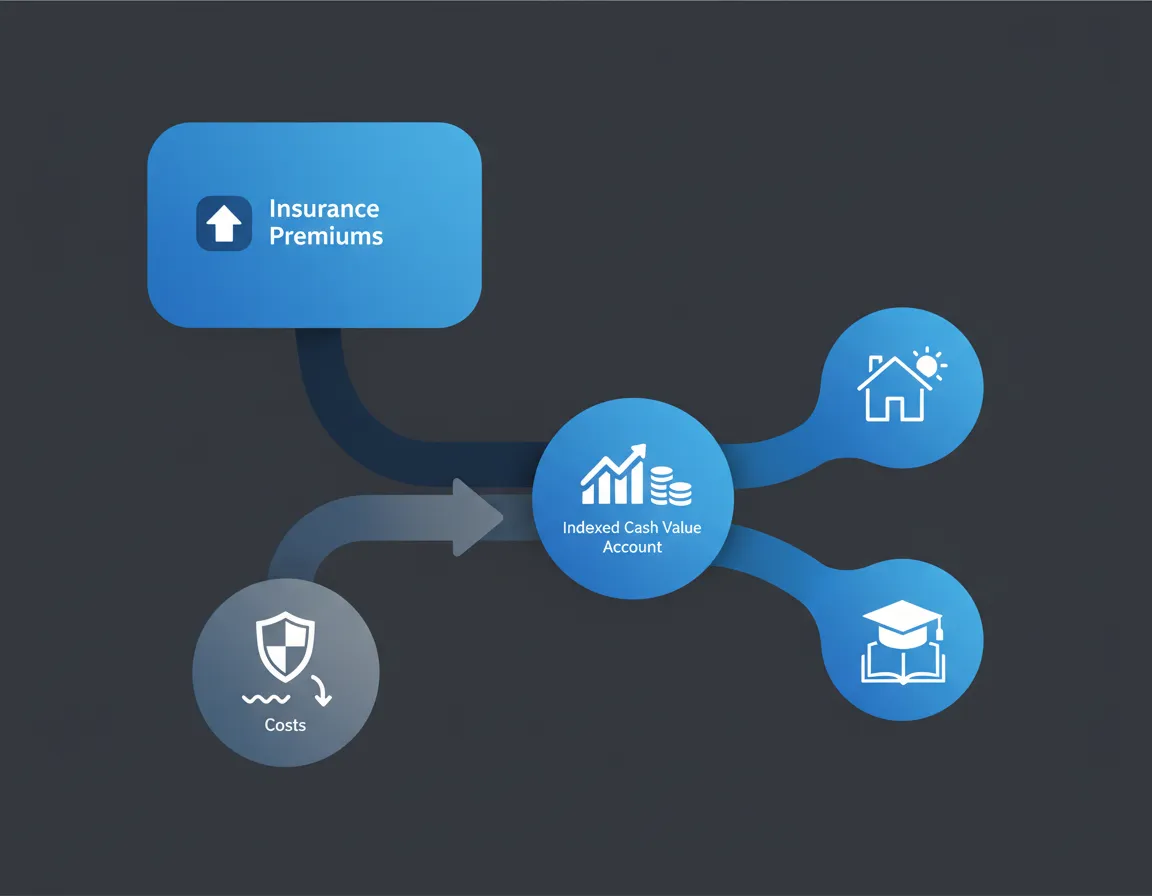

How Index UL works

Your premiums power protection and long-term growth.

Each premium you pay funds a combination of insurance costs and a cash value account. That account can grow based on performance of one or more market indexes, subject to caps and floors set by the insurer.

- You choose how much to pay, within policy limits.

- Insurer allocates a portion to cover insurance and expenses.

- Remaining value is credited interest tied to market index performance.

- Cash value can be accessed via loans or withdrawals (subject to policy rules).

Note: Index UL is a long-term strategy. Policy values and performance depend on your funding pattern, index choices, and how you use the policy over time.

At a glance: your IUL cash value journey

- Floor: minimum crediting rate helps protect against negative index years.

- Cap: maximum rate limits how much of strong index years you receive.

- Participation: determines what % of index movement is credited to your account.

Our specialists help you understand these levers so your policy is designed for long-term stability—not short-term speculation.

Protection & living benefits

More than a policy. A safety net for every chapter of life.

Index UL combines permanent life insurance with the ability to tap into your cash value while you’re still here—for opportunities, emergencies, or health events.

- Income-tax-free death benefit for your loved ones

- Potential riders that accelerate benefits in case of chronic, critical, or terminal illness

- Cash value access that doesn’t require bank underwriting or loan applications

- Ability to supplement retirement income without triggering additional current taxes (if structured properly)

Important: Accessing cash value via loans or withdrawals will reduce your death benefit and policy values, and may increase the risk of lapse. We help you model these tradeoffs before you make decisions.

Protection snapshot

- $250,000–$3,000,000+ customizable coverage

- Coverage designed to last your entire lifetime

- Options to increase or decrease benefit over time

Compare your options

Where Index UL fits among common savings & insurance tools.

Traditional savings

- Liquidity: High

- Growth: Low, interest taxed annually

- Protection: No death benefit

- Tax treatment: Interest taxed as ordinary income

Term life insurance

- Liquidity: No cash value

- Growth: None, pure protection

- Protection: Death benefit only, for a set term

- Tax treatment: Death benefit generally income-tax-free

Index Universal Life

- Liquidity: Access to cash value via loans/withdrawals

- Growth: Index-linked with downside protection

- Protection: Permanent coverage with optional living benefits

- Tax treatment: Tax-deferred growth, potential tax-advantaged access

Best for: Individuals seeking a long-term strategy that blends protection, tax advantages, and flexible access to cash value.

Real client stories

How Index UL helped clients grow and protect their wealth.

“We wanted to protect our young family and still keep our money working. Our Index UL policy became a flexible bucket we could tap into for a down payment, while still keeping long-term protection in place.”

Maria & James • Age 34 & 36

Young family using IUL for protection and future goals

“As we approached retirement, our advisor showed us how an IUL policy could create a tax-advantaged income stream that complements our 401(k) and Social Security. The balance of growth and protection made sense for us.”

Daniel • Age 59

Pre-retiree seeking tax diversification and legacy planning

Common questions

Index UL explained in plain language.

Is Index Universal Life right for me?

Index UL can be a fit if you want permanent life insurance, value tax-advantaged long-term growth, and are comfortable committing to funding the policy for many years. It’s not ideal if you need the lowest-cost pure death benefit—term life usually fits that goal better.

Can I lose money in an Index UL policy?

While your cash value is protected from direct market losses, policy charges and poor funding can cause the policy to underperform or even lapse. Index UL is designed to reduce downside risk through floors and guarantees, but it is not a bank account or a guaranteed investment.

What if I need to access my cash value?

Most policies allow you to access cash value through withdrawals or loans. Loans typically do not require credit checks or underwriting, but they do accrue interest and will reduce your death benefit and policy values if not repaid.

How does Index UL compare to maxing out my 401(k) or IRA?

For many people, the first step is to take full advantage of employer retirement plans and tax-favored accounts. Index UL can complement—not replace—those vehicles by adding another tax-advantaged bucket with a death benefit and unique distribution features.

What are the risks of Index UL?

Risks include underfunding the policy, changes in index caps and participation rates, and taking too much cash value out too quickly. We use conservative modeling and ongoing reviews to help you understand and manage these risks over time.

See how Index UL could support your goals.

In a brief conversation, we’ll clarify whether Index UL is a fit, walk through a custom illustration, and outline a funding strategy designed around your timeline and risk comfort.

- No pressure. No jargon.

- Clear side-by-side comparison with your current strategy.

- Delivered digitally so you can review with family or your advisor.

By scheduling, you acknowledge that Index UL is a long-term product and that all strategies should be reviewed with your tax and legal professionals.

Quick snapshot info

- Typical time: 20–30 minutes

- Format: Video or phone call

- You’ll get: Custom IUL illustration and action plan